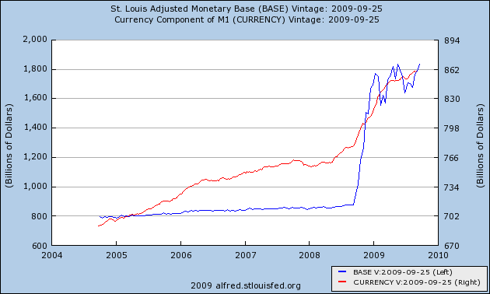

The mainstream argument would go as follows: The dramatic spike in bank reserves is not indicative of potential crisis in the near future but rather our attempt to promote bank lending in an attempt to get commerce back to normal in all aspects of the economy. This, however, is in direct contradiction to the Fed's decision to pay banks interest on the reserves they have recently injected into the system, or in other words an incentive to not lend that money. Only one logical conclusion can be drawn from this. The Fed is aware of and prepared for a combination of the following: Another substantial banking crisis (this time likely due to a spike in loan losses rather than toxic assets), or the inevitable fallout of the commercial real estate market (which again would mean substantial loan losses).

This comes ahead of the unemployment numbers (which may show the economy crossing the threshold of double digit unemployment, but only if the temporary effects of the stimulus have faded). My intuition tells me it is either a pre-emptive move to ensure to the public that the banking system is adequately capitalized should either unemployment be higher than expected, pay-roll numbers lower than expected or the GDP revision worse than expected (all of which would spur the public to question whether the banking system could withstand more economic turbulence. In other words the Fed's attempt to instill an artificial sense of confidence into the market is in hopes that they will continue to increase spending, and give the illusion Big Ben has indeed saved the day. Unfortunately, as time will tell, the end-game is a currency crisis that could potentially break the USD.

Peter Schiff made an excellent point that supports my argument. Bernanke claims the economy is back on a path of growth (the degree to which is not important), yet the Fed minutes say they will hold rates at 0% indefinitely. Even with the emergency rate cuts in 2001 by our former (just a reckless Fed chairmen), the short end of the curve still bottomed out at 1%. So why can't we have 1-2% rates (which are very low to begin with)? Well I think I indirectly answered that in the above paragraphs. We have only seen the tip of iceberg and the Fed knows it.

No comments:

Post a Comment