Commodities across the board have seen a fair degree of profit taking in December, providing an opportunity to initiate/increase positions in futures and equities in various industries. Several trends present in 2009 should continue well into the next decade, most notably the precious metals (Gold, Silver and Palladium due to their role as a store of value in addition to the increasing industrial use in the latter two), Oil (the supply-demand disconnect will be augmented by the debasement of most all major currencies) and various agricultural commodities (such as sugar, cotton,etc) should continue this trend as they can also be looked at as an alternative to oil. The best investment in agriculture could very well be wheat, which wasn't among the top agriculture investments in 2009.

Wheat has very unique characteristics relative to many other commodities, starting with an increasing supply-demand disconnect.

Wheat has seen the gap between world production and world consumption narrow nearly every year over the last decade, likely due to the emergence of the BRIC countries. Given the numerous studies available by various organizations i.e USDA, I will only point out developments in the U.S. Since 2002. The ending wheat stock in the U.S has been declining despite increases in production and imports (below ending stocks in 1950). U.S. wheat flour use per capita has been rising while total wheat planted area is also below the 1950 level of 70 million acres. This may not come as a shock as the price (prior to the economic crisis in the commodity market), rose sharply from 2005-2008. While the fundamentals remain unchanged, the market price has been bid down well below the real economic value.

This, however, is only one reason to be bullish on wheat and wheat-related companies. Wheat, along with the precious metals and oil, has historically risen the most and the quickest once society realizes consumer prices are headed higher. Though gold, silver and oil have seen a violent rise in prices from the 2009 lows, wheat remains rather ignored. Wheat is my pick in the commodity sector for 2010 and beyond, followed by silver and oil and finally gold.

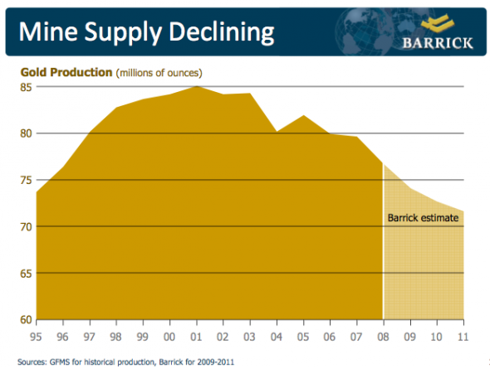

A previous article highlighting silver can be found here as it is a much more detailed analysis than I would provide here. Oil has enough published articles and statistics, bringing my attention to gold and an interesting presentation by Barrick (ABX), explaining their rationale for eliminating their hedge book after gold reached record highs above $1200/oz. To summarize this presentation (which can be found on their website), Barrick (having the largest hedge book in the industry for years) points out the decline in worldwide mining output (below) coupled with the abnormally small market for this storied metal and worldwide currency debasement, will send the price of the yellow much higher in the years to come. Having a mining company commenting on their bullish view is nothing new, but their actions support this genuine belief in the future of gold. Barrick took a massive 3.4+ billion dollar writedown while pursuing large projects which require large capital requirements (such as Pascua-Lama).

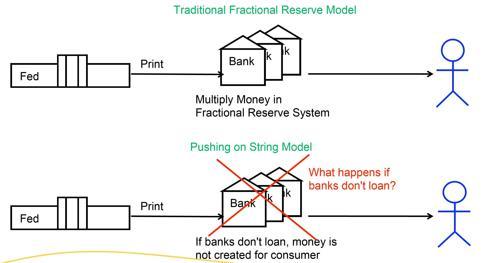

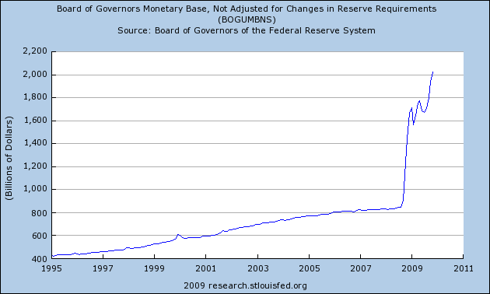

Rampant currency debasement via monetary policy (open market operations) and Fiscal policy (record deficit spending, explosion in the gross federal debt) in the U.S is being done on a scale so massive, hyperinflation doesn't sound that farfetched. In fact I think it would be hard to avoid should the banks start to lend all the excess reserves in the system (which has shot up the last two months likely due to fear the system would otherwise be in jeopardy as loan losses start to be realized). Courtesy of what is technically legalized counterfeiting (Fractional Reserve Banking) through the issuance of more or less fake warehouse receipts (illustrated below) has created more future damage than any other government policy has the capability of doing.

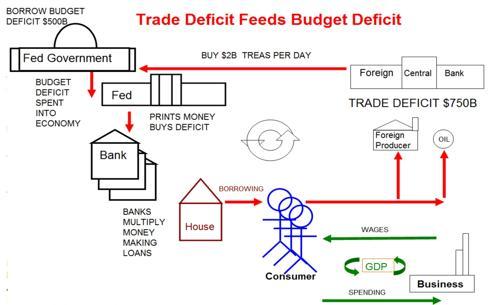

We have a surge in the base money supply and all other monetary aggregates, an explosion in the trade deficit (over a 15 year period), record deficit spending (Obama just announced his desire for another stimulus package), trillions of worthless commercial paper on the books of the Fed (MBS), trillions of potential loan losses (potentially 90% inflationary assuming to interest or principal payments have been made), trillions spent on bailouts, over 80 trillion in total debt (NPV of future unfunded liabilities) and wasteful government programs with several more set to be enacted at any time (i.e. healthcare). The full degree of the damage already created is unprecedented (in terms of purchasing power of the USD), but the same inflationary policies continue to inflict more damage to USD as we speak, making the aforementioned commodities insurance (on the purchasing power of a soon to be deteriorating dollar) which should be part of every investor's strategy going forward.

Investing in commodities doesn't require an investor to trade futures as many common stock, ETFs, ETNs and equity options will provide more than adequate exposure. Precious metal miners, notably royalty companies in particular provide a fairly prudent investment while maintaining leverage to the price of the underlying commodities as opposed to GLD or SLV which have no leverage, expense ratios and questionable auditing. Franco-Nevada (FNNVF.PK) and Royal Gold (RGLD) are my picks for playing gold, while Silver Wheaton (SLW) remains an excellent exposure to silver with reduced mining risk. Wheat can be played through such vehicles as the DBA (double agriculture).

No comments:

Post a Comment