What is the real money Supply

The True Money Supply (TMS) was formulated by Murray Rothbard and represents the amount of money in the economy that is available for immediate use in exchange. It has been referred to in the past as the Austrian Money Supply, the Rothbard Money Supply and the True Money Supply. The benefits of TMS over conventional measures calculated by the Federal Reserve are that it counts only immediately available money for exchange and does not double count. MMMF shares are excluded from TMS precisely because they represent equity shares in a portfolio of highly liquid, short-term investments which must be sold in exchange for money before such shares can be redeemed.

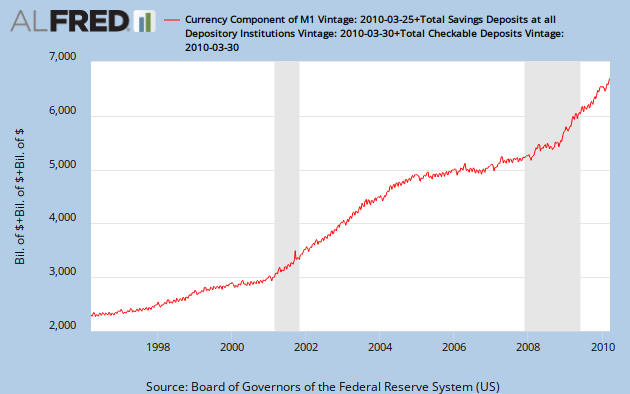

The TMS consists of the following: Currency Component of M1, Total Checkable Deposits, Savings Deposits, U.S. Government Demand Deposits and Note Balances, Demand Deposits Due to Foreign Commercial Banks, and Demand Deposits Due to Foreign Official Institutions.

Note: The following only contains inflation that has worked its way through the system shown through the increase in the money supply. It fails to account for deficit spending/debt monetization, >2.3 Trillion of worthless commercial paper held by the fed , currently in the form of reserves ( as they mark-to-market), stimulus packages, future mortgage defaults, etc.

No comments:

Post a Comment