How do royalty companies work? They royalty company pays an upfront fee ( to help finance the development of various mines) in exchange for the right to purchase silver at approx $4/oz and gold at $450/oz (although they vary). I recommend doing ones one due diligence to get an idea between the difference between streams and royalties as royalties have multiple types including GSR(Gross Smelter Revenue), NPI (Net Profit Interest), GPR (GROSS PROCEEDS ROYALTY),CGR(CONTAINED GOLD RETURNED), (NET SMELTER ROYALTY) and SSR(SLIDING SCALE ROYALTY). They also do not need sustained capital expenditures going forward except the one time upfront payment when an acquisition is made.

First I will talk about the streamers - Silver Wheaton, Gold Wheaton, Sandstorm Resources. What's unique about them relative to pure royalties? They receive the physical metal instead of cash payments for a fixed price (as mentioned above) in addition to having a much more favorable tax situation courtesy of the Canadian Government. As long as they reinvest their proceeds or pay it out as dividends, they are stuck with a tax rate in the neighborhood of 0-8%, a huge advantage when it comes to net profit margin. I will start with Sandstorm as they made the most recent acquisition, which is a game changer in my opinion.

Sandstorm Resources (SNDXF.PK) - A gold royalty company focusing on advanced stage or producing mines. Though they have only been operating for a basically a year and a half or so, they have already completed four royalty acquisitions. This is amazing accomplishment given they are a micro/small cap company ( <200m market capitalization ). They have an amazing management team headed by CEO Nolan Watson (former CFO of Silver Wheaton). They are very well capitalized, following an acquisition in early March, with nearly 90m of cash on hand. This gives them ample room to deploy at least 60m of their cash balance off in the near term (as they have a bit over 100m in long term debt). Available funding will dramatically increase, however, over the year as three of their four royalty streams will come online, with the fourth & fifth expected in 2011. They can also revert back to more equity financing (which I personally think they should do ) as they recently moved up to top tier status on the venture exchange, thus they will attract more attention. They have made it clear they are and will continue to be very aggressive on the acquisition front going forward, recently commenting they are in several advanced stage talks with various companies.

Similarities to Silver Wheaton - Silver Wheaton is recognized for their superior management as they have been able to grow future peak production levels from 0 in 2004 to 45m by early 2010 ( expected to be reached in 2013-2014). But what stands out is the fact they have been able make these acquisitions on extremely favorable terms, with all in costs amounting to more or less 8.00/oz of silver with the exception of a few deals such as Rosemont. One would expect having the former CFO of Silver Wheaton as CEO of Sandstorm, acquisitions would be on comparable terms. In fact, they are currently the lowest cost producer relative to Royal Gold, Franco-Nevada and Gold Wheaton. The average cost per attributable ounce is less than $400/oz. Additionally, like Silver Wheaton, they have little tax liability, another comparative advantage to Royal Gold and Franco-Nevada.

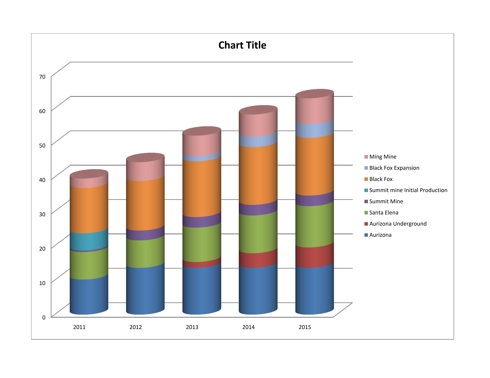

The following is a brief rundown of their royalty agreements thus far:

- Aurizona Project - 17% of attributable gold production for LOM, which will initially produce 60k oz/year, ramping up to 80k year with cash costs of $400/oz. They also have the option to purchase 17% of the gold produced from the underground mine (should Luna Corp decide to develop it). In this case annual gold production will increase to a range of 100k-125k/year.

- Saint Elena - 20% of attributable of the projected 40k annual production. The kicker here is the purchase price of just $350/oz.Additionally this mine has underground potential which Sandstorm will have claim to should they develop it. This would bring total mine production to an estimated 60-70k/year.

- Summit Mine - Sandstorm will initially receive 50% of the first 10k mined, followed by a 22% interest in this small mine. Production estimates are expected to be between 12-14k/ year. Cash costs again are at the low end $400/oz. The operator also has the right to offer Sandstorm an additional 25% interest. This is a key example of generating immediate cash flow (indicated through the provision above).

- Ming Mine - Production expected to commence in mid 2011. Initially Sandstorm will receive 25% of the first 175k produced followed by 12% thereafter. Gold production is projected to range from 20-25k annually, with excellent upside potential.

- Black Fox Mine - Sandstorm will begin receiving streams in Jan 11'. Initially it will be %12 of the production from the Black fox mine which has enormous exploration upside. The deal also include the right to the Black Fox expansion for a 10% interest. Altogether, this royalty has the capability of producing anywhere from 180k/year to 220k/year, depending on the success of the Black Fox expansion which looks great so far.

In other words, production levels will grow from approx 10k in 2010 to 60k by 2014 or 2015 ( assuming none of the companies decide to pursue underground mines and Summit mines does not offer the additional 25% interest) or approx 36-38k assuming they do. This seems like small pickings relative to the other royalty companies but you have to put it into perspective. Investments are made in hopes of making the highest possible return given the risk involved. Sandstorm resources offer just that: When it comes to valuation, assuming a long term gold price of $1,300/oz, my valuation ranges between $1.75-$2/share. Of course valuations are very subjective with regards to required rate of return, LT gold price, etc, but such a price to value disconnect in the valuation mentioned above makes it worth a look.

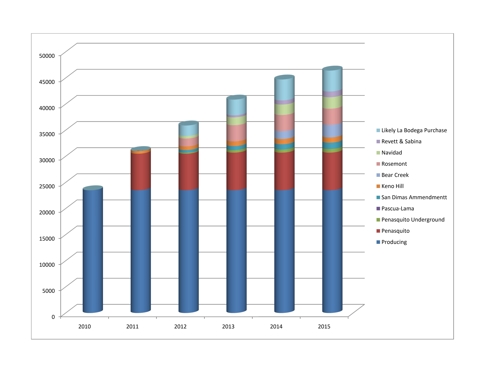

Silver Wheaton - Has not been active on the acquisition front of late, but they are now cashed up and ready to acquire another cornerstone asset, the likes of which will be either 25-50% of the silver from the La Bodega mine (which will prove to be substantial or another cornerstone asset. With many of their liabilities paid off in the recent quarter plus 2.2m of stockpiled silver, Silver Wheaton is worth keeping an eye on. My guess would be an acquisition in the 4-6m ounce range in addition to a smaller stream in the coming year. This should bring their peak production levels to the 50m ounce market with plenty of OCF to continue their aggressive growth. I say this due to what mgmt said on the conference call (they have never been more active talking to various companies about near term of future financing). A dividend will also likely be announced towards the latter half of 2011 which in most cases act as a catalyst for stock prices due to the cash flow stream investors will receive.

Some additional information from my last post will be repeated to sum up what Silver Wheaton has accomplished throughout the year and the upside potential that still remains.

- "Most recently the amendment to the San Dimas stream, which Goldcorp (GG) agreed to sell to Mala Noche. Not only does the contract of the stream extend from 29 years to the life of the mine, but the attributable ounces receivable will increase both short and long term. As part of the amendment, Mala noche will sell the first 3.5m ounces mined and 50% of production beyond this point. Goldcorp will add 1.5m ounces on top of this for the first 4 years, at which time Mala Noche will sell the first 6m ounces mined and 50% of production beyond this point. But there are additional implications to this which most analysts either miss or choose to ignore. As Luisman was not a core asset to Goldcorp, there was far less incentive to maximize production and engage in aggressive exploration on the rest of the property. Mala Noche, on the other hand, has already laid out expansion and exploration plans which Silver Wheaton will benefit from. By 2012, total attributable ounces to Silver Wheaton will range from 7.8m-8m ounces as opposed to approx 5.8,m in 2009. Mala Noche has already said they plan a mill expansion at San Dimas, increasing throughput anywhere from 15%-20%. Assuming the high exploration potential only results in an additional 500-1m oz of silver (which is on the very conservative side of mgmt’s expectations), Long term silver payable to SLW should range between 8-8.5m oz by 2014-2015 ( as SLW is only entitled to 50% of production past 6m oz).This deal will make Luisman’s (which is combined of 3 different mines on the same property) NAV greater than that of Pascua-Lama.

- Contractual agreement with Ventana regarding SLW’s right of first refusal on the La Bodega mine. This option will likely be exercised as Ventana is faced with high capital requirements to bring La Bodega online. I could see Ventana selling 25-50% of the silver recovered to SLW in exchange for up front financing. Although annual gold and silver production is still unknown, drilling at La Bodega indicates a world class mine. I think it is safe to say this will at some point turn into at least a 2m oz stream, though somewhere between 4-5m+ is more likely.

- Pascua-Lama is likely to contribute more than the projected 9m ounces consensus. World class mines such as this more often than not increases production guidance as time goes on before commercial production begins. A great example is one of SLW’s cornerstone assets (Penasquito), which was estimated to be approx 5m attributable ounces to SLW when it was at a similar stage in the construction process as Pascua-Lama. This coupled with the exploration potential increases the likelihood production guidance will increase beyond the current estimates.

- It is looking increasingly more likely Goldcorp will pursue development of an underground operation at Penasquito sometime over the next 2-5 yrs. SLW is also entitled to purchase 25% of silver produced from the underground mine.

- SLW has numerous additional assets that are overlooked for the most part. These include a 15% in the Corani Project (Bear Creek), 17% interest in Revett Minerals Rock Creek project, 7% in Sabina’s Hackett River mine and a 11% interest in Mines mgmt’s Montanore Mine. While all but Corani is still in the pre-feasibility stage, Corani is expected to come online in 2013 with average annual production estimated to be 10-12m oz/year."

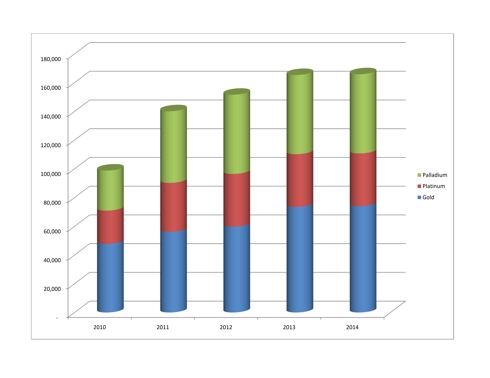

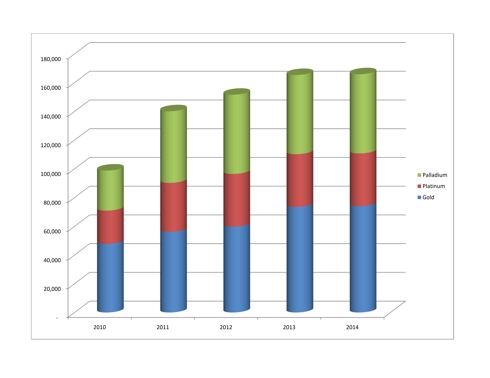

Gold Wheaton: I expect another acquisition relatively soon as they are cashed up are in need of finding a source of long term growth. Making an acquisition is a geopolitically safe jurisdiction will act as a huge catalyst to the stock price and it is still very depressed despite the recent run up. This is due to the fact they only have 2 streams, one of which is in South Africa, and we all know how than can end up. Their production profile looks as follows:

While they have a nice diversified portfolio of metals, any disruption in their first uranium stream will cause the stock to plummet, thus my reasoning for the need to make a new purchase, even if it is a relatively small acquisition. You also have to consider gold wheaton trades at a large discount to other royalty companies (below .9x NAV) compared to the like of say Royal Gold who it trading around 2x NAV.

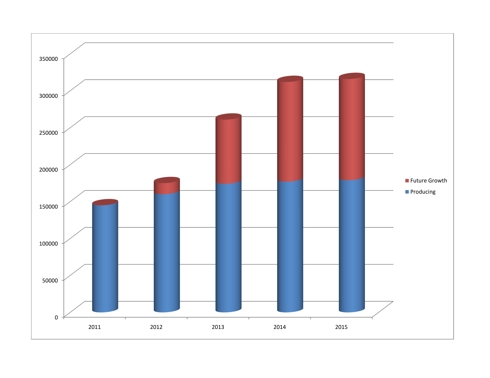

Royal Gold - Who has been very aggressive on the acquisition front, purchasing IRC(International Royal Company earlier in the year) , followed by an additional royalty for Pascua-Lama and of course one of their biggest acquisitions to date Mt. Milligan. It Has slowly but surely become one of my favorite companies due to the simple fact that they believe in their product and know its going much higher going forward, something that many miners lack the foresight to see. Royal Gold has been around for approx 40 years and they have never been aggressive as they have been the past two year, reinforcing my argument that they are a strong believer in the yellow metal as well as other commodities including silver and copper. Royal Gold still has plenty of cash and access to debt to continue growing their company.

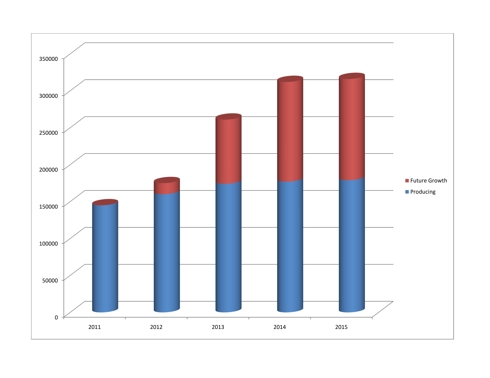

Unfortunately unlike the streaming companies, Royal gold is subject to the US statutory rate of 35%, which does hurt the net margins rather substancially on a relative basis but is more than negated by their agressive nature. This management knows what they are doing and I expect more big purchases in the years ahead. With their recent purchases Royal Gold has dramatically increase their medium and long term growth profile, which will exceed 300k annually by 2013-2014 if everything continues to be on track. Their main growth drivers relative to 2010 are Voisey's Bay, Cortez, Pascua-Lama, Andacallo, Penasquito and Mt.Milligan. Mt.Milligan and Andacallo both being streams, a new model royal gold seems to be adapting, opposed to the customary purchases of plain royalties, which I consider to be a very good thing.

Franco Nevada -has been by far the biggest the biggest disappointment in the industry as the denial of Prosperity;s permit was denied, leaving Franco will substantial reinvestment risk. They don't have a tremendous portfolio to begin with, at least compared to their peers but also are loaded with too much excess cash in my opinion. As Gold has run up $400 in the last year, these royalties are becoming much more expensive to purchase, as in total all in costs (Cap-ex + purchase price). They need to act and do it quickly. I had the utmost respect for mgmt but they are acting as if they don't understand the importance of gold in this environment and future inflation that awaits us. Don't get me wrong, they do have some very high quality assets and have realized extreme upside on many of them (including Turmalina , now operated by kinross).

I have changed my favorite royalties/streamers since the first article to the following including valuations at current spot price with the risk/reward taken into account. These valuations were determine using various metrics such as valuation ratio, OCF multiple and DCF.

While they have a nice diversified portfolio of metals, any disruption in their first uranium stream will cause the stock to plummet, thus my reasoning for the need to make a new purchase, even if it is a relatively small acquisition. You also have to consider gold wheaton trades at a large discount to other royalty companies (below .9x NAV) compared to the like of say Royal Gold who it trading around 2x NAV.

Royal Gold - Who has been very aggressive on the acquisition front, purchasing IRC(International Royal Company earlier in the year) , followed by an additional royalty for Pascua-Lama and of course one of their biggest acquisitions to date Mt. Milligan. It Has slowly but surely become one of my favorite companies due to the simple fact that they believe in their product and know its going much higher going forward, something that many miners lack the foresight to see. Royal Gold has been around for approx 40 years and they have never been aggressive as they have been the past two year, reinforcing my argument that they are a strong believer in the yellow metal as well as other commodities including silver and copper. Royal Gold still has plenty of cash and access to debt to continue growing their company.

Unfortunately unlike the streaming companies, Royal gold is subject to the US statutory rate of 35%, which does hurt the net margins rather substancially on a relative basis but is more than negated by their agressive nature. This management knows what they are doing and I expect more big purchases in the years ahead. With their recent purchases Royal Gold has dramatically increase their medium and long term growth profile, which will exceed 300k annually by 2013-2014 if everything continues to be on track. Their main growth drivers relative to 2010 are Voisey's Bay, Cortez, Pascua-Lama, Andacallo, Penasquito and Mt.Milligan. Mt.Milligan and Andacallo both being streams, a new model royal gold seems to be adapting, opposed to the customary purchases of plain royalties, which I consider to be a very good thing.

Franco Nevada -has been by far the biggest the biggest disappointment in the industry as the denial of Prosperity;s permit was denied, leaving Franco will substantial reinvestment risk. They don't have a tremendous portfolio to begin with, at least compared to their peers but also are loaded with too much excess cash in my opinion. As Gold has run up $400 in the last year, these royalties are becoming much more expensive to purchase, as in total all in costs (Cap-ex + purchase price). They need to act and do it quickly. I had the utmost respect for mgmt but they are acting as if they don't understand the importance of gold in this environment and future inflation that awaits us. Don't get me wrong, they do have some very high quality assets and have realized extreme upside on many of them (including Turmalina , now operated by kinross).

I have changed my favorite royalties/streamers since the first article to the following including valuations at current spot price with the risk/reward taken into account. These valuations were determine using various metrics such as valuation ratio, OCF multiple and DCF.

| SANDSTORM | $1.77 | ACCUMULATE |

| SILVER WHEATON | $52.20 | BUY ON DIPS |

| ROYAL GOLD | $84.79 | BUY ON DIPS |

| GOLD WHEATON | $6.16 | BUY ON DIPS |

| FRANCO-NEVADA | $38.94 | HOLD UNTIL FURTHER NEWS |

No comments:

Post a Comment